Big Beautiful Prediction

The "One Big Beautiful Bill" passed the U.S. House of Representatives a bit over a month ago. The House held a vote on May 22nd at 1:00 AM (yes, you read that correctly – 1:00 in the morning), and the bill passed by a razor-thin margin of 215-214. One member missed their vote after reportedly falling asleep.

On July 1st, the Senate approved the bill with some amendments, requiring the House to vote again on the revised version. The House has now passed the amended bill, and the only remaining step is for President Trump to sign it for it to officially become law.

I'm not here to provide a full breakdown of the bill's contents, but a few of the headline provisions include:

- Making the 2017 Trump tax cuts permanent

- Eliminating taxes on tips and overtime.

- Significant spending cuts on Medicaid

- Increased funding for border security and defense

Rather than judge the policies themselves, I want to focus on what this bill could mean for financial markets if it becomes law. According to early estimates from the Congressional Budget Office, the legislation would increase the U.S. budget deficit by more than $3.8 trillion over the next decade...

Why does this even matter? Well, running a deficit means the government is spending more than it's bringing in through tax revenues. Governments finance deficits by issuing debt. In the U.S., that means the Treasury sells short- and long-term instruments: T-bills, notes, and bonds. These issuances add to the national debt, which is the accumulation of past deficits. If spending continues to outpace revenues for years on end, interest payments on the debt become an increasingly heavy burden.

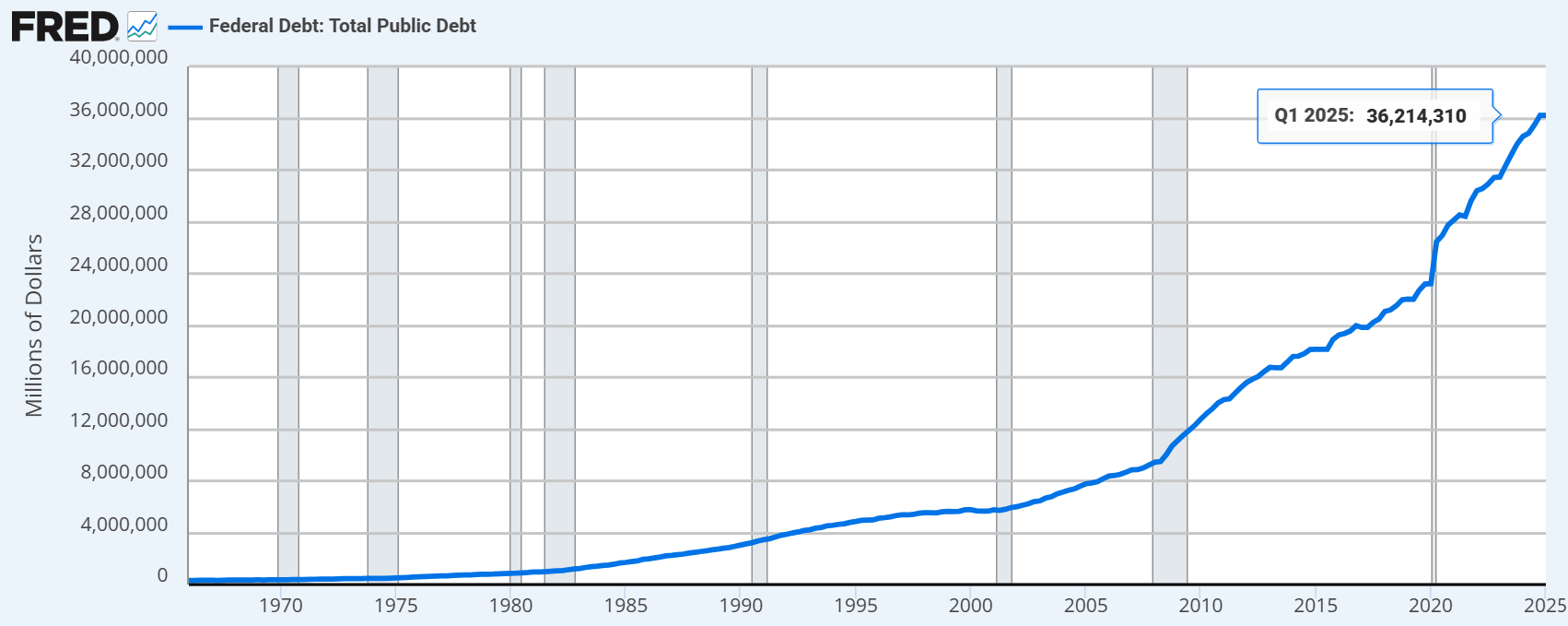

As you may start to piece it together, if the deficits are consistent year-over-year, debt levels begin to compound, and the flywheel begins to take off:

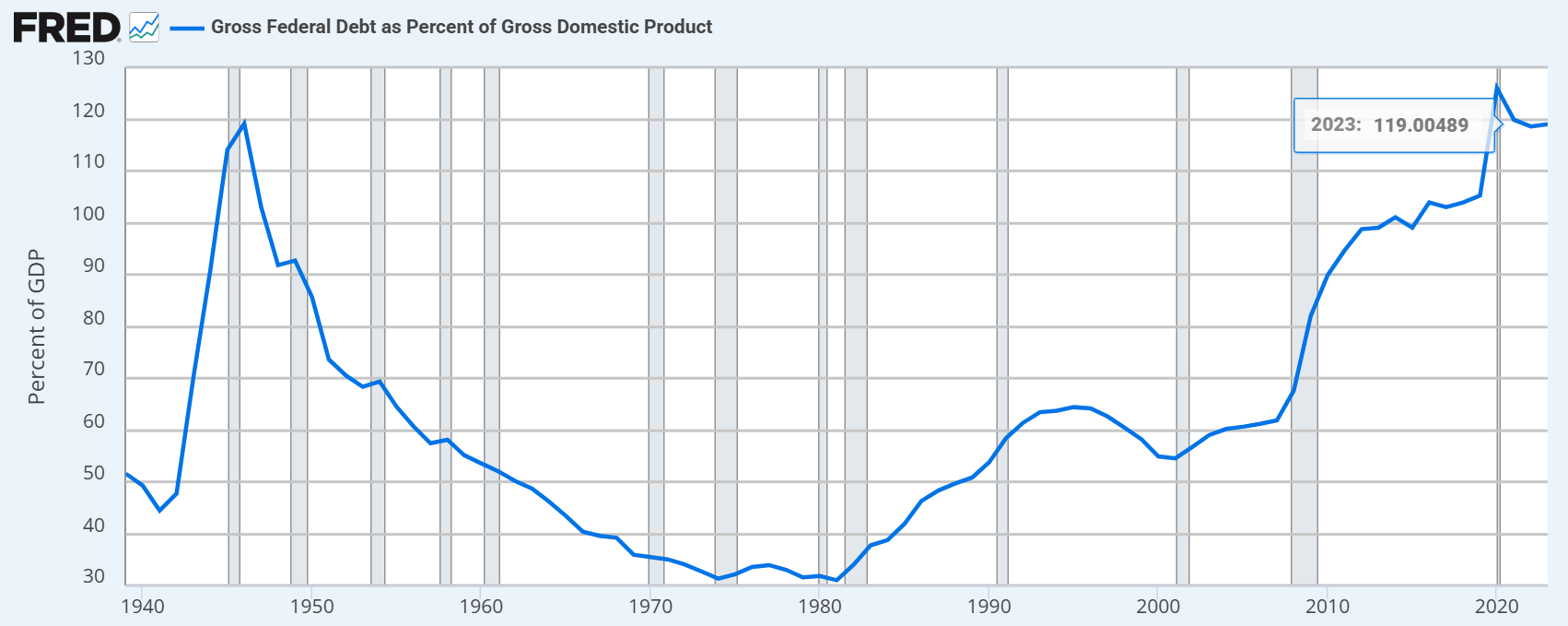

The total debt balance of the U.S. isn't really the best measure, as it only represents the running balance of debt. A better measure that highlights the problem is gross debt as a percentage of gross GDP:

As we can see, the level of debt has been racking up quite significantly. The U.S. has surpassed the levels it reached in the mid 90's, but the situation during that time was vastly different and high debt levels were warranted – the U.S. was in the midst of WWII...

The bill is now in the hands of President Trump. Once signed, I believe financial markets will interpret the move as fiscally irresponsible and structurally unsustainable. The most immediate signal would likely come from the bond market – with yields rising across both short and long maturities as investors demand more compensation to hold U.S. debt. And when rates rise, so do the government's borrowing costs.

In short, the U.S. is on track for a spin on the doom loop:

higher debt → higher interest burden → larger deficits → even more borrowing

Although the effect may not be immediate, I expect the following chain reaction:

- There will be a significant selloff in equities as investors reassess risk and growth expectations.

- Capital will flow out of the U.S. toward regions perceived as more fiscally disciplined.

We’ve already seen early warning signs. Earlier this year, during "Liberation Day" (the announcement by Trump involving massive tariffs – even targeting the Heard and McDonald Islands, of which, are primarily inhabited by penguins), markets reacted sharply:

- Equities sold off

- Yields rose

- The U.S. dollar weakened

In short, there was a scare of capital flight: investors losing confidence and reallocating funds outside of the U.S.

Even though the bill may be labeled as "beautiful," the outcome for financial markets will be quite ugly... If passed, it could signal to the world that the U.S. is drifting away from sound fiscal management. Investors are watching closely. And if confidence wavers, markets may not wait long to respond.

The U.S. has long enjoyed the privileges that come with being crowned the world’s reserve currency. However, those privileges rest on a foundation of trust – in its institutions, in its stability, and in its commitment to long-term fiscal responsibility. If that foundation begins to falter and crack, so too might the markets that depend on it.

##

I took a trip to Vancouver Island this past weekend to celebrate my sister's wedding – This photo was taken on our first day there, enjoying the beautiful sunset views along the coast!

Member discussion